The Mansa-X Story

Welcome to Mansa-X Fund, where the legacy of Mansa Musa, the illustrious 9th Emperor of Mali and one of history’s wealthiest figures, inspires our foundation. Drawing upon Mansa Musa’s legendary trade achievements in salt, gold, and more, our investment strategy mirrors the diversity and success of his empire.

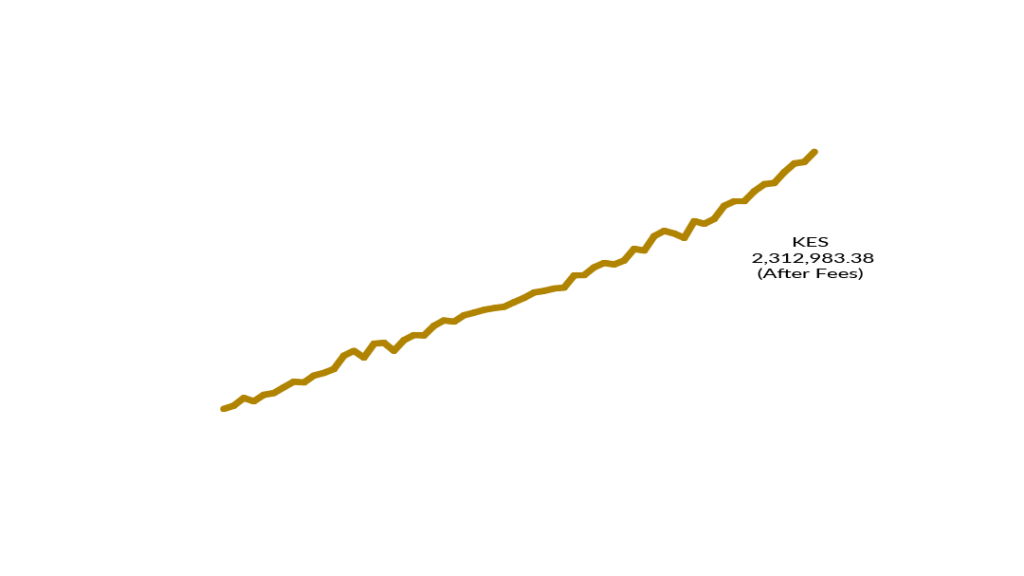

Mansa-X is a Multi-Asset Strategy Fund that employs a sophisticated long/short trading model tailored to maximize client returns even amidst market volatility while safeguarding their investments against downturns. The fund is a product of Standard Investment Bank, which is licensed and regulated as a money manager by the Capital Markets Authority of Kenya.

Available in both KES & USD denominations, Mansa-X Fund is your gateway to resilient and prosperous investment, rooted in the rich heritage of African success and innovation.